Are you a financial coach looking to expand your reach and connect with potential clients on the world’s largest social media platform? Facebook offers an incredible opportunity to engage with a vast audience, but finding the right people who truly require your expertise can be a difficult task. You don’t have to be afraid of this: we’ll walk you through the steps to find and target the ideal audience on Facebook for your financial coaching services.

You can learn the strategies you require in a matter of seconds. We can assist you in developing buyer personas that speak to your audience and ensuring that your Facebook targeting options are tailored to your target markets. We will also look at A/B testing, compliance considerations, and how to track campaign performance in depth. We’re excited to show you how to build a successful financial coaching business on Facebook.

Keep reading to learn how you can take your financial coaching business to the next level by tapping into a pool of potential clients who want to improve their financial well-being. Whether you’re a seasoned financial coach or a newcomer, this article contains the necessary knowledge to learn how to reap the benefits of Facebook advertising. We’ll go over the steps to reach the right audience and meet your business objectives in this video.

Understanding Financial Coaching

In the world of personal finance, a powerful ally awaits those seeking to take control of their financial destinies: financial coaching. This distinct discipline sets itself apart from traditional financial advising or planning, offering a personalized and empowering experience that addresses individuals’ unique financial challenges. So, what is financial coaching, and how does it differ from other financial services? Let’s delve into the heart of this transformative practice.

Financial coaching, at its core, is a dynamic process that centers on guiding and supporting individuals in their pursuit of financial well-being. Unlike traditional financial advising, which primarily involves offering recommendations and solutions, financial coaching takes a more holistic approach. It seeks to empower clients by honing their financial knowledge, skills, and behaviors. The financial coach, acting as a trusted partner, collaborates with clients to explore their financial beliefs, goals, and obstacles, working together to cultivate a deeper understanding of their money-related choices.

Central to the distinction between financial coaching and financial planning is the emphasis on individual empowerment. While financial planning is predominantly transactional and goal-focused, financial coaching engages clients on a more profound level, nurturing self-awareness and fostering lasting behavioral changes. By helping clients uncover their unique values and aspirations, financial coaching paves the way for more meaningful financial decisions and long-term success.

Embracing financial coaching unlocks an array of benefits, rendering it a powerful catalyst for personal financial growth. First and foremost, financial coaching cultivates financial empowerment. It equips individuals with the necessary tools and knowledge to confidently navigate the complexities of personal finance, ultimately reducing feelings of financial stress and uncertainty. As clients become more adept at managing their money, they gain a renewed sense of control over their financial destinies, empowering them to make sound financial decisions aligned with their life goals.

Moreover, financial coaching serves as a powerful motivator, instilling a sense of accountability in clients. Through ongoing support and guidance, coaches keep clients focused and committed to their financial objectives. The process entails setting clear, achievable milestones, allowing clients to track their progress and celebrate their successes along the way. This sense of accountability not only enhances financial discipline but also fosters a proactive mindset, encouraging clients to tackle financial challenges with confidence and determination.

Beyond empowerment and accountability, financial coaching also nurtures emotional intelligence when it comes to money matters. Money can evoke powerful emotions, and understanding the emotional triggers surrounding financial decisions is crucial for sustainable financial well-being. Coaches adeptly navigate these emotional landscapes, helping clients recognize and manage emotional responses to money, enabling them to make more rational and balanced financial choices.

Additionally, financial coaching fosters a growth mindset regarding finances. By challenging limiting beliefs and self-imposed barriers, coaches open clients’ eyes to new possibilities. They encourage individuals to embrace a growth-oriented approach, where setbacks are viewed as opportunities for learning and growth rather than insurmountable obstacles. As clients develop this mindset, they become more receptive to exploring innovative strategies and taking calculated risks, setting the stage for financial breakthroughs.

Identifying Potential Clients for Financial Coaching

In the world of personal finance, seeking the guidance of a financial coach has become increasingly popular among individuals seeking to gain control over their financial lives. These potential clients are characterized by specific traits and face unique challenges that prompt them to seek the support and expertise of a financial coach. Let’s explore the key characteristics, financial challenges, and life events that often lead individuals to seek the services of a financial coach.

1. Characteristics of Potential Clients for Financial Coaching:

- Financially Overwhelmed: Many potential clients seeking financial coaching services find themselves overwhelmed by various financial obligations, such as debt, mortgages, or student loans. They feel the weight of financial stress and seek professional assistance to regain control of their financial situation.

- Lack of Financial Knowledge: Some individuals lack sufficient financial knowledge and struggle to understand complex financial concepts and investment strategies. Financial coaching offers them an opportunity to bridge this knowledge gap and make more informed decisions.

- Goal-Oriented: Potential clients often have specific financial goals they wish to achieve, such as buying a house, saving for retirement, or funding their children’s education. They recognize that a financial coach can help them chart a clear path to achieving these goals.

- Desire for Accountability: Financial coaching clients value accountability and recognize the importance of having someone who will hold them responsible for their financial actions and progress towards their goals.

- Life Transitions: Significant life changes, such as getting married, starting a family, or changing careers, can lead individuals to seek the support of a financial coach to navigate these transitions successfully.

2. Common Financial Challenges Faced by Potential Clients:

- Living Beyond Means: Many individuals struggle with overspending and living beyond their means, leading to mounting debts and financial instability.

- Lack of Budgeting Skills: Budgeting challenges can hinder individuals from effectively managing their finances and saving for the future.

- Inadequate Emergency Funds: A lack of emergency funds can leave individuals vulnerable to financial setbacks and unexpected expenses.

- Investment Confusion: Potential clients may face confusion and uncertainty regarding investment options, hindering their ability to grow their wealth effectively.

- Debt Management: Managing debts can be daunting, especially when dealing with multiple creditors and varying interest rates.

3. Life Events and Milestones Prompting the Need for Financial Coaching:

- Marriage and Family Planning: The decision to get married or start a family often prompts individuals to seek financial coaching to plan for the future together and ensure financial security.

- Job Changes or Loss: Major career shifts, such as changing jobs or experiencing unemployment, may lead individuals to reevaluate their financial strategies and seek guidance during these transitions.

- Retirement Planning: Approaching retirement age encourages individuals to seek financial coaching to optimize retirement savings and plan for a comfortable post-retirement life.

- Inheritance or Windfall: Receiving an inheritance or windfall can be overwhelming, leading individuals to seek financial coaching to make the most of these sudden financial gains.

- Purchasing Property: Potential homeowners may seek financial coaching to navigate the complexities of purchasing property and securing a mortgage.

Defining the Target Audience on Facebook

In the dynamic landscape of digital marketing, Facebook has emerged as a powerful platform for businesses to connect with their audience and drive meaningful engagements. As businesses seek to capitalize on the vast user base of this social media giant, the importance of defining a specific target audience for Facebook advertising becomes paramount. A well-defined target audience ensures that promotional efforts are directed at the right people, maximizing the impact of marketing campaigns and achieving a higher return on investment (ROI). Let’s explore the significance of defining the target audience on Facebook and the advantages of utilizing Facebook’s sophisticated targeting features to reach potential clients effectively.

1. The Importance of Defining a Specific Target Audience:

- Precision Marketing: Defining a specific target audience enables businesses to engage in precision marketing, where their ads are strategically tailored to resonate with the interests and needs of the intended audience. This approach minimizes wastage and ensures that resources are efficiently channeled towards reaching potential clients who are more likely to convert into customers.

- Relevance and Personalization: When businesses target a specific audience, they can deliver personalized and relevant content that addresses the pain points and desires of the intended audience. This level of personalization fosters a deeper connection with potential clients, increasing the likelihood of conversions and long-term brand loyalty.

- Optimized Ad Performance: By narrowing down the target audience, businesses can optimize their ad performance and enhance the overall effectiveness of their Facebook advertising campaigns. A well-defined target audience allows businesses to analyze and refine their ad strategies, ensuring that their messaging aligns with the preferences and behaviors of potential clients.

2. Advantages of Using Facebook’s Targeting Features:

- Detailed Demographics: Facebook’s targeting features provide businesses with access to an extensive array of demographic data, including age, gender, location, education, and marital status. This level of granularity empowers businesses to precisely define their target audience based on specific characteristics, ensuring that their ads reach individuals who match their ideal customer profiles.

- Interests and Behavior Targeting: Facebook’s targeting capabilities extend beyond demographics, enabling businesses to target potential clients based on their interests, hobbies, and online behaviors. By understanding the preferences and activities of their target audience, businesses can tailor their ad content to match the lifestyles and aspirations of potential clients.

- Custom Audiences and Lookalike Audiences: Facebook allows businesses to create custom audiences based on their existing customer data, website visitors, or email lists. Additionally, businesses can leverage lookalike audiences, which consist of individuals who share similarities with their existing customers. This powerful feature expands the reach of businesses to include potential clients who exhibit traits similar to their most valued customers.

- Retargeting Opportunities: Facebook’s retargeting capabilities enable businesses to reconnect with users who have previously interacted with their website or engaged with their content. By reengaging these warm leads, businesses can nudge potential clients towards conversion and strengthen brand recall.

Creating Buyer Personas

Developing comprehensive buyer personas is a pivotal step in designing successful marketing strategies for financial coaching services. These fictional representations of the ideal clients serve as invaluable tools for understanding the needs, preferences, and behaviors of the target audience. Crafting accurate and relatable buyer personas requires a deep exploration of the demographic and psychographic aspects that shape the potential clients’ decision-making process. Let’s embark on a journey of creating buyer personas that resonate with the target audience and drive impactful marketing efforts.

1. Guide on Developing Buyer Personas for Financial Coaching Services:

- Research and Data Analysis: Begin by conducting thorough research and gathering data on existing clients and potential prospects. Utilize surveys, interviews, and analytics to collect insights into their financial goals, challenges, and motivations.

- Identify Common Characteristics: Look for patterns and commonalities among the data collected to identify the demographic and psychographic traits that define the target audience.

- Creating Persona Profiles: Develop persona profiles that encapsulate the unique attributes and pain points of different segments within the target audience. These personas should reflect real-world characteristics to ensure authenticity and relevance.

2. Defining the Demographic and Psychographic Aspects of the Personas:

- Demographic Aspects: Define the demographic attributes of the personas, including age, gender, marital status, education, occupation, and income level. These factors provide a foundational understanding of the audience’s background and financial circumstances.

- Psychographic Aspects: Dive deeper into the psychographic aspects of the personas, delving into their values, beliefs, attitudes, and lifestyle choices. Explore their financial aspirations, risk tolerance, and emotional relationship with money. Understanding the psychological nuances enables businesses to connect with the personas on a deeper level.

3. Providing Examples of Crafting Resonant Personas:

- The Ambitious Young Professional: Meet Alex, a 30-year-old marketing manager with ambitious financial goals. As a persona, Alex values career advancement and seeks guidance on investing and building wealth for the future.

- The Recent Graduate: Emily, a 24-year-old recent college graduate, embodies this persona. Emily is burdened by student loans and seeks financial coaching to develop budgeting skills and make informed decisions about managing her debt.

- The Midlife Career Changer: Represented by Mark, a 40-year-old accountant transitioning to entrepreneurship, this persona desires financial guidance to navigate the uncertainties of starting a business while securing his family’s future.

- The Empty Nesters: Sarah and John, both 55 years old, are empty nesters seeking financial coaching to plan for retirement and ensure a comfortable life after decades of raising their children.

By crafting these personas, financial coaching businesses can create targeted content and tailor their services to align with the unique needs of their audience. These personas serve as touchstones, guiding the creation of personalized marketing messages and resonant solutions that foster a deeper connection with potential clients. As businesses leverage these powerful insights, they embark on a journey of understanding their audience on a profound level, earning their trust, and ultimately outranking other websites with a personalized and impactful marketing approach.

Leveraging Facebook’s Targeting Options

In the ever-evolving realm of digital marketing, Facebook stands as an unrivaled platform for businesses seeking to connect with their target audience on a personal level. One of the key pillars of Facebook’s advertising prowess lies in its sophisticated targeting options, which provide businesses with unparalleled access to potential clients based on demographics, interests, and behaviors. By harnessing these detailed targeting options effectively, financial coaching services can navigate through the vast sea of Facebook users and hone in on the most promising prospects. Let’s explore the diverse targeting options that Facebook offers and uncover how businesses can leverage them to reach potential clients for financial coaching services.

1. Exploring Facebook’s Detailed Targeting Options:

- Demographics: Facebook allows businesses to target potential clients based on various demographic factors, including age, gender, education, occupation, marital status, and income level. This level of granularity ensures that businesses can tailor their messaging to specific segments of their target audience.

- Interests: Facebook’s interest-based targeting allows businesses to reach users based on their hobbies, interests, and preferences. By understanding the interests of potential clients, businesses can craft content that resonates with their passions, making their ads more engaging and relevant.

- Behaviors: Facebook’s behavioral targeting empowers businesses to reach users based on their online activities, device usage, purchase behaviors, and travel preferences. This invaluable feature provides insights into users’ habits and enables businesses to identify potential clients with specific financial needs.

2. Effectively Using Facebook’s Targeting Options for Financial Coaching:

- Narrow Down the Audience: Start by narrowing down the target audience based on the specific financial coaching services offered. Define the ideal client profiles and use Facebook’s demographics and interests targeting to reach individuals who match these profiles.

- Custom Audiences and Lookalike Audiences: Utilize Facebook’s custom audience feature to target existing clients or website visitors. By creating lookalike audiences, businesses can expand their reach to potential clients who share similar characteristics with their existing customers, increasing the chances of finding valuable leads.

- Engage Warm Leads: Implement retargeting strategies to engage users who have previously interacted with the business’s website or engaged with their content. These warm leads are more likely to convert into clients with tailored messaging and enticing offers.

- A/B Testing: Conduct A/B testing on different ad elements, such as images, ad copy, and calls-to-action, to identify the most effective combination. Facebook’s targeting options enable businesses to serve these variations to different segments of the audience, optimizing ad performance.

3. Case Study: Tailoring Ads to Reach Potential Financial Coaching Clients:

- Targeting New Graduates: A financial coaching service targeting new graduates can use Facebook’s demographic targeting to focus on individuals within the age range of 22-25, who have recently completed their education.

- Reaching Small Business Owners: A financial coaching service catering to small business owners can leverage Facebook’s interests targeting to connect with users interested in entrepreneurship, business development, and financial management.

- Retirement Planning for Mid-Career Professionals: A financial coaching service specializing in retirement planning can use Facebook’s behavioral targeting to reach mid-career professionals with interests in investments and retirement planning.

Custom Audiences and Lookalike Audiences

In the realm of digital marketing, the ability to precisely target the right audience is a key differentiator for success. Facebook, with its advanced advertising capabilities, offers businesses two powerful tools – custom audiences and lookalike audiences – to enhance their targeting precision and expand their reach. These dynamic features have revolutionized the way businesses connect with potential clients, maximizing the impact of their marketing efforts. Let’s delve into the benefits of creating custom audiences based on existing clients or website visitors and explore how lookalike audiences can significantly expand a business’s reach to users similar to their existing clients.

1. Benefits of Creating Custom Audiences:

- Personalized Marketing: Custom audiences allow businesses to engage with individuals who have already shown an interest in their products or services. By targeting existing clients or website visitors, businesses can deliver personalized content that resonates with their specific needs and preferences.

- Enhanced Conversion Rates: Custom audiences are more likely to convert into customers since they are already familiar with the business. Targeting individuals who are in the consideration or decision-making phase of the buying process can significantly boost conversion rates and drive measurable results.

- Reconnecting with Warm Leads: Through custom audiences, businesses can re-engage with warm leads who may have shown interest in the past but did not convert. By staying top-of-mind through targeted advertising, businesses can nurture these leads and encourage them to take the desired action.

2. The Power of Lookalike Audiences:

- Expanding Reach: Lookalike audiences enable businesses to reach users who share similar characteristics with their existing clients or website visitors. This powerful feature helps businesses tap into new markets and broaden their reach beyond their current customer base.

- Qualified Prospects: Lookalike audiences are highly valuable as they consist of users who have not yet engaged with the business but share similar interests, behaviors, and demographics with existing customers. This alignment increases the likelihood of these prospects being interested in the business’s offerings.

- Targeted Reach with Precision: Lookalike audiences are not merely about reaching a larger audience; they are about reaching the right audience. Businesses can specify the size and similarity percentage of the lookalike audience, ensuring the targeting remains precise and effective.

3. Case Study: Harnessing Custom and Lookalike Audiences for Financial Coaching Services:

- Custom Audience: Website Visitors: A financial coaching service can create a custom audience based on users who visited specific pages on their website, such as those related to retirement planning or debt management. Targeting this custom audience with tailored ads can drive higher engagement and conversions among users already interested in these topics.

- Custom Audience: Existing Clients: By creating a custom audience of existing clients, a financial coaching service can run personalized upsell or referral campaigns. These ads can promote advanced coaching packages or encourage satisfied clients to refer friends and family, leveraging the trust and loyalty of the existing customer base.

- Lookalike Audience: Similar Financial Goals: A financial coaching service can build a lookalike audience based on users who have financial goals similar to those of their existing clients. By targeting this lookalike audience, the business can connect with potential clients who are likely to benefit from their services, as they share similar aspirations and objectives.

Crafting Compelling Advertisements

In the fast-paced digital landscape, crafting compelling advertisements is the cornerstone of successful marketing campaigns for financial coaching services. Capturing the attention of potential clients amidst the sea of online content requires a delicate balance of engaging and persuasive messaging. To stand out from the competition and drive meaningful interactions, businesses must employ strategies that resonate with their audience, leverage clear and concise messaging, and harness the power of visuals and compelling call-to-action (CTA). Let’s delve into the art of creating persuasive ad content that captivates potential clients and leads them to seek the valuable guidance of financial coaching services.

1. Tips for Creating Engaging and Persuasive Ad Content:

- Identify Pain Points: Understand the challenges and pain points of the target audience when it comes to their financial situation. Tailor the ad content to address these pain points and offer solutions that evoke curiosity and interest.

- Craft a Compelling Value Proposition: Clearly communicate the unique value and benefits of financial coaching services. Highlight how the services can empower individuals to achieve their financial goals and experience positive transformations in their lives.

- Emphasize Expertise and Trustworthiness: Establish credibility and trust by showcasing the expertise and qualifications of the financial coaches. Use testimonials and success stories to provide social proof of the service’s efficacy.

2. The Importance of Clear and Concise Messaging:

- Captivate with the Headline: Craft attention-grabbing headlines that pique curiosity and compel users to read further. A concise yet powerful headline can make a significant difference in catching the audience’s eye.

- Embrace Brevity: In the age of information overload, concise messaging is crucial. Deliver the main message succinctly, avoiding jargon and unnecessary fluff.

- Focus on Benefits: Center the ad content around the benefits that potential clients can gain from financial coaching services. Clearly communicate how their lives will improve by taking advantage of the expertise offered.

3. Harnessing the Power of Visuals and Call-to-Action (CTA):

- Visual Storytelling: Utilize eye-catching visuals, such as images and videos, that resonate with the target audience. Visual storytelling can evoke emotions, making the ad content more memorable and impactful.

- Compelling Call-to-Action (CTA): Include a clear and actionable CTA that prompts users to take the desired next step, whether it’s signing up for a consultation, downloading a free resource, or scheduling a coaching session.

- Mobile-Optimized Design: Ensure that the ad content is mobile-friendly, as a significant portion of users access content on their smartphones. A seamless mobile experience contributes to better engagement and conversions.

4. Case Study: A Persuasive Ad Campaign for Financial Coaching Services:

- Visual Storytelling: A financial coaching service can create an ad campaign that features real success stories of clients who have achieved financial milestones through their services. Accompanying visuals can portray the journey from financial stress to empowerment, creating an emotional connection with the audience.

- Compelling CTA: The ad campaign can incorporate a compelling CTA such as “Transform Your Finances Today” or “Start Your Journey to Financial Freedom.” This empowers potential clients to take action and seek the guidance they need.

- Highlight Benefits: The ad content can emphasize benefits such as “Achieve Your Financial Goals Faster,” “Gain Confidence in Money Management,” and “Take Control of Your Financial Future.”

A/B Testing and Optimization

In the ever-evolving world of digital advertising, where attention is a scarce commodity, achieving optimal results requires a strategic approach that goes beyond mere intuition. Enter A/B testing, a powerful tool that enables financial coaching services to refine their advertising strategies, resonate with their audience, and boost conversion rates. A/B testing, also known as split testing, involves comparing two versions of an advertisement to determine which one performs better. By systematically testing different elements in ad campaigns, financial coaching services can uncover valuable insights, make data-driven decisions, and optimize their advertising efforts for maximum impact. Let’s explore the significance of A/B testing, the key elements to test in financial coaching ads, and the iterative optimization process that unlocks improved results.

1. The Significance of A/B Testing:

- Data-Driven Decision Making: A/B testing allows financial coaching services to make decisions based on real data rather than assumptions. By running controlled experiments, businesses can identify what truly resonates with their audience and tailor their ads accordingly.

- Continuous Improvement: A/B testing fosters a culture of continuous improvement. As marketing trends and consumer behavior evolve, financial coaching services can adapt their strategies to stay relevant and maintain a competitive edge.

- Maximizing ROI: In the realm of paid advertising, maximizing return on investment (ROI) is paramount. A/B testing helps businesses optimize their ad spend by investing in the most effective ad variations that yield the best results.

2. Elements to Test in Financial Coaching Ads:

- Headlines: Experiment with different headlines to gauge which ones capture the audience’s attention and entice them to engage further.

- Ad Copy: Test variations in ad copy length, tone, and messaging to determine the most compelling language that resonates with the target audience.

- Visuals: Explore different images, graphics, and video content to identify visuals that evoke emotions and establish a strong connection with potential clients.

- CTA (Call-to-Action): Experiment with various CTAs to find the most persuasive one that drives users to take the desired action, whether it’s signing up for a consultation or downloading a resource.

3. The Iterative Optimization Process:

- Hypothesis Formation: Start by forming clear and testable hypotheses for each element to be tested. For example, “A shorter ad copy will result in higher click-through rates.”

- Sample Size and Duration: Ensure that the sample size for each test is statistically significant to obtain reliable results. Run the tests for an appropriate duration to account for variations in user behavior over time.

- Data Analysis: Analyze the data collected from the A/B tests to determine which variations perform better. Look for patterns and trends that can guide future optimizations.

- Implementing Changes: Based on the insights gained from the A/B tests, implement the changes in the ad campaigns. Continuously monitor performance to ensure improvements are sustained.

- Testing Iteratively: A/B testing is not a one-time activity. As the business landscape evolves, continue testing and refining ad elements to maintain an optimal advertising strategy.

4. Case Study: Iterative Optimization for Financial Coaching Services:

- Headlines: A financial coaching service conducts A/B testing on two different headlines for an ad promoting debt management services. They discover that the headline “Break Free from Debt and Achieve Financial Freedom” outperforms “Get Help with Managing Your Debt” with a 20% higher click-through rate.

- Ad Copy: The service tests two variations of ad copy – one emphasizing immediate financial relief and the other focusing on long-term financial stability. They find that the latter generates a 15% higher conversion rate, indicating that users are more interested in long-term solutions.

- Visuals: The financial coaching service experiments with images of diverse individuals successfully managing their finances. They notice a 25% increase in engagement with ads featuring relatable visuals, affirming the importance of representation in advertising.

Compliance and Legal Considerations

As financial coaching services harness the power of Facebook advertising to connect with potential clients, it is imperative to navigate the intricate landscape of compliance with financial regulations and advertising policies. Operating within the confines of relevant laws and guidelines not only protects the integrity of the financial coaching industry but also builds trust with clients and strengthens the brand’s reputation. Let’s delve into the importance of compliance and the guidelines to ensure all advertisements meet legal requirements and Facebook’s advertising policies.

1. The Importance of Compliance with Financial Regulations:

- Ethical Conduct: Compliance with financial regulations upholds the ethical conduct of financial coaching services, ensuring fair and transparent practices that prioritize the well-being of clients.

- Credibility and Trust: Adhering to regulations fosters credibility and trust in the financial coaching industry, as potential clients are more likely to seek guidance from services that demonstrate a commitment to compliance.

- Avoiding Legal Consequences: Non-compliance can result in legal repercussions, fines, and damage to a company’s reputation. Following regulations mitigates the risk of legal entanglements and safeguards the business’s sustainability.

2. Guidelines for Adherence to Legal Requirements and Advertising Policies:

- Transparent Disclosures: Provide clear and transparent disclosures in advertisements, ensuring that clients are informed about the nature of the services offered, fees, and any potential risks involved.

- Avoiding Deceptive Content: Ensure that all ad content is accurate and does not mislead potential clients about the benefits or outcomes of financial coaching services.

- Compliance with Consumer Protection Laws: Abide by consumer protection laws that safeguard the interests of clients and prevent deceptive practices.

- Privacy and Data Protection: Adhere to data protection regulations, safeguarding client information and ensuring secure data handling practices.

- Responsible Lending: If financial coaching services offer assistance with debt management or loans, comply with lending laws and responsible lending practices.

- Third-Party Partnerships: If partnering with third-party service providers, ensure they also adhere to relevant financial regulations and industry standards.

3. Facebook’s Advertising Policies:

- Prohibited Content: Familiarize yourself with Facebook’s prohibited content guidelines, which include restrictions on misleading claims, illegal products, and deceptive practices.

- Discrimination Policies: Ensure that ads do not violate Facebook’s discrimination policies by targeting or excluding users based on sensitive attributes such as race, religion, or gender.

- Use of Images: Comply with Facebook’s image guidelines, which specify acceptable content and image dimensions for ads.

- Compliance with Community Standards: Adhere to Facebook’s community standards, avoiding content that promotes violence, hate speech, or harassment.

- Age-Restricted Content: If financial coaching services cater to specific age groups, use Facebook’s age restrictions to target appropriate audiences.

4. Case Study: Ensuring Compliance in Financial Coaching Advertisements:

- Disclosures: A financial coaching service runs ads promoting investment advice and explicitly discloses that their services are for informational purposes only and do not constitute financial advice. They include disclaimers about the risks associated with investing in the fine print of their ads to ensure transparency.

- Images and Language: The service avoids using misleading images of luxurious lifestyles in their ads and instead features relatable visuals of clients achieving their financial goals through responsible planning.

- Privacy and Data Security: The financial coaching service highlights their commitment to client privacy and data security, assuring potential clients that their personal information is handled with utmost confidentiality and adheres to data protection laws.

In conclusion, compliance with financial regulations and advertising policies is not a mere formality; it is an ethical imperative that underscores the responsibility of financial coaching services to prioritize the best interests of their clients. By adhering to legal requirements and Facebook’s advertising policies, financial coaching services can build credibility, foster trust, and establish themselves as reputable and reliable advisors. Transparent disclosures, accurate content, and adherence to community standards are essential components of compliant advertising campaigns that resonate with the target audience. In this digital age, where consumer awareness and regulatory scrutiny are at an all-time high, compliance is not a constraint but an opportunity to demonstrate professionalism and integrity. Embrace compliance as a guiding principle in your advertising journey and ensure that your financial coaching services thrive in a landscape built on trust, transparency, and regulatory adherence.

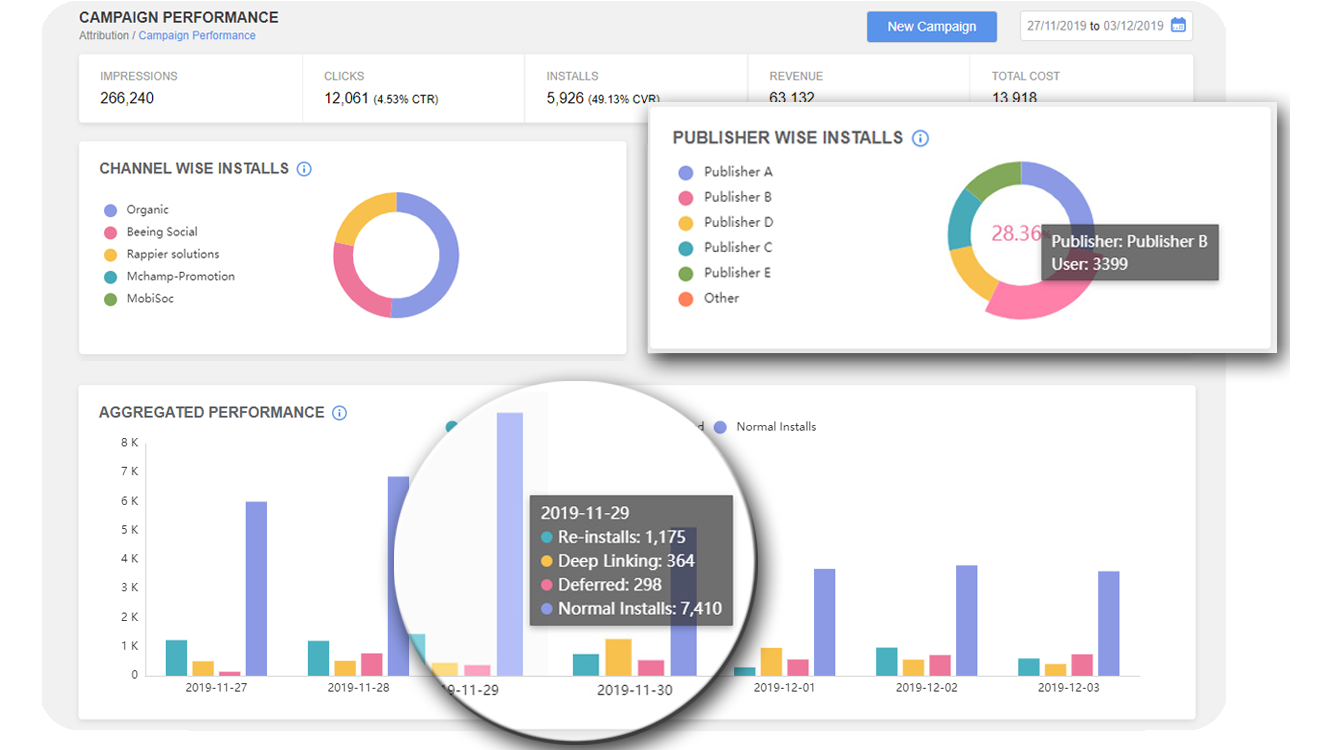

Tracking and Analyzing Campaign Performance

In the dynamic world of Facebook advertising, tracking and analyzing campaign performance play a pivotal role in ensuring the success of financial coaching advertisements. Understanding the importance of tracking key metrics, identifying relevant indicators of effectiveness, and employing the right tools and methods for analysis are essential steps in optimizing ad campaigns and achieving optimal results. Let’s delve into why tracking and analyzing campaign performance are critical, explore relevant metrics for assessing financial coaching advertisements, and discover the tools and methods to gain valuable insights.

1. The Importance of Tracking Key Metrics:

- Informed Decision-making: Tracking key metrics provides valuable data to make informed decisions throughout the campaign, enabling financial coaching services to pivot strategies and allocate resources effectively.

- Budget Optimization: Monitoring performance metrics allows businesses to optimize their advertising budget, channeling resources into strategies that yield the highest return on investment (ROI).

- Continuous Improvement: Regular tracking fosters a culture of continuous improvement, empowering financial coaching services to refine their ad content, targeting, and messaging based on real-time feedback.

2. Relevant Metrics for Assessing Financial Coaching Advertisements:

- Click-Through Rate (CTR): CTR measures the percentage of users who click on an ad’s link, indicating how engaging the ad is to the target audience.

- Conversion Rate: Conversion rate tracks the percentage of users who take the desired action, such as signing up for a consultation or subscribing to a newsletter, reflecting the ad’s effectiveness in driving actions.

- Cost per Click (CPC): CPC indicates the average cost of each click on an ad, helping to evaluate the cost-effectiveness of the campaign.

- Return on Ad Spend (ROAS): ROAS assesses the revenue generated for every dollar spent on advertising, giving insights into the campaign’s profitability.

- Engagement Metrics: Metrics like likes, comments, and shares provide a glimpse into the ad’s engagement levels and audience resonance.

3. Tools and Methods for Analyzing Campaign Performance:

- Facebook Ads Manager: Facebook Ads Manager offers a comprehensive dashboard to monitor ad performance, providing access to a wealth of data, including CTR, conversion metrics, and audience insights.

- Google Analytics: Integrating Google Analytics with Facebook campaigns offers a holistic view of user behavior, allowing businesses to track website traffic, bounce rates, and conversion paths.

- A/B Testing: Conducting A/B tests by creating variations of ads and measuring their performance helps identify the most effective elements and optimize ad content.

- Tracking Pixels: Implementing tracking pixels on the website enables businesses to track user interactions, such as form submissions or page visits, and tie them back to specific ads.

- Attribution Models: Employing different attribution models, such as first-click or last-click attribution, sheds light on which touchpoints contribute most to conversions.

4. Case Study: Analyzing Campaign Performance for a Financial Coaching Service:

- Goal Setting: A financial coaching service launches a Facebook ad campaign to increase sign-ups for their financial planning workshops.

- Tracking Metrics: They track CTR, conversion rate, and ROAS to measure the campaign’s performance.

- Analysis: After two weeks, they analyze the data and find that one ad variant has a significantly higher CTR and conversion rate, indicating that it resonates better with the audience.

- Optimization: The financial coaching service reallocates their budget to focus on the high-performing ad variant, resulting in increased workshop sign-ups and improved ROAS.

Budgeting and Bid Strategies

When it comes to Facebook advertising for financial coaching campaigns, setting an appropriate budget and employing the right bid strategies are critical components to ensure the best return on investment (ROI) and reach the target audience effectively. Crafting a well-thought-out budget plan and choosing the right bid strategies will enable financial coaching services to optimize their ad spend, maximize reach, and achieve their advertising objectives. Let’s delve into insights on budgeting and bid strategies to ace the game of Facebook advertising.

1. Setting an Appropriate Budget:

- Identify Advertising Goals: Define clear advertising goals, whether it’s increasing website traffic, generating leads, or driving sales, to allocate the budget effectively.

- Consider Audience Size: Larger target audiences may require a higher budget to reach effectively, while smaller, niche audiences may be cost-efficient.

- Start Conservatively: When launching a new campaign, start with a conservative budget to test the waters and assess initial performance.

- Analyze Past Performance: Review past campaigns to identify average cost per conversion and other key metrics, guiding budget allocation for future campaigns.

- Seasonal Considerations: Factor in seasonal trends or events that may impact ad performance and adjust the budget accordingly.

2. Various Bid Strategies and Their Implications:

- Lowest Cost (Auto) Bidding: Facebook’s automatic bidding sets bids to get the lowest cost per optimization event. It’s suitable for businesses looking for cost-efficient conversions but may sacrifice some control over bid amounts.

- Target Cost Bidding: Advertisers can set a target cost, and Facebook optimizes bids to achieve that cost. It strikes a balance between control and cost-effectiveness.

- Cost Cap Bidding: Advertisers can set a maximum cost per optimization event, giving them control over costs while ensuring Facebook stays within the specified cap.

- Bid Cap Bidding: Allows advertisers to set a maximum bid amount, providing flexibility in bidding while controlling costs.

- Value Optimization (VO) Bidding: Uses machine learning to optimize bids for maximum value, suitable for campaigns with high-value conversions.

3. Tailoring Budget and Bid Strategies for Financial Coaching Campaigns:

- Budget Distribution: Depending on campaign goals, allocate the budget across different ad sets to test multiple target audiences and ad creatives.

- Testing Bid Strategies: A/B test various bid strategies to find the most effective one for the financial coaching campaign, focusing on the best ROI.

- Optimizing for Conversions: Choose bid strategies that prioritize conversion optimization to drive sign-ups, consultations, or subscriptions.

- Monitoring and Adjusting: Continuously monitor campaign performance and adjust budgets and bid strategies based on real-time data to enhance results.

4. Case Study: Optimizing Budget and Bid Strategies for a Financial Coaching Service:

- Goal Setting: A financial coaching service aims to increase lead generation and consultations through Facebook advertising.

- Budget Allocation: They allocate a budget to test multiple ad sets targeting different demographics and interests to gauge performance.

- Bid Strategy Testing: The financial coaching service runs a split test with different bid strategies to identify the most cost-effective approach.

- Optimization: After analyzing the results, they discover that the Cost Cap Bidding strategy yields the highest number of qualified leads at a reasonable cost.

- Refining the Approach: The financial coaching service reallocates the budget to focus on the ad sets with the highest conversion rates and adjusts the bid strategy accordingly.

In conclusion, mastering budgeting and bid strategies is the key to successful Facebook advertising for financial coaching services. By setting an appropriate budget aligned with advertising objectives and employing the right bid strategies tailored to campaign goals, financial coaching services can optimize their ad spend, reach the right audience, and achieve remarkable results. Careful analysis of past performance, continuous monitoring, and data-driven decision-making are crucial elements in fine-tuning budget allocation and bid strategies for improved ROI. In the ever-evolving landscape of Facebook advertising, mastering the art of budgeting and bid strategies is a game-changer for financial coaching campaigns seeking to outrank competitors and connect with their target audience effectively.

Case Studies and Success Stories

Real-life case studies of successful financial coaching campaigns on Facebook serve as compelling evidence of the platform’s potential to drive remarkable results for businesses. By analyzing the strategies and tactics employed in these campaigns, we gain valuable insights into the impact they have on achieving the desired goals. Let’s delve into some noteworthy case studies that exemplify how financial coaching services can leverage Facebook advertising to connect with their target audience effectively.

1. Case Study: Achieving Financial Freedom with Personalized Coaching

Objective: A financial coaching service aimed to promote its personalized coaching sessions to individuals seeking financial freedom and better money management.

Strategy:

- Audience Segmentation: The campaign began by segmenting the target audience based on demographics, interests, and behaviors. This allowed the service to tailor messages to resonate with each group effectively.

- Compelling Ad Content: Engaging ad content emphasized the benefits of personalized coaching, such as debt reduction, investment strategies, and long-term financial planning.

- Visual Appeal: The use of visually appealing graphics and videos enhanced ad performance, capturing users’ attention while scrolling through their feed.

- Call-to-Action (CTA): A clear CTA prompted users to sign up for a free consultation or download a financial planning guide, encouraging immediate action.

Impact:

- Lead Generation: The campaign generated a significant increase in leads, with a 35% higher conversion rate compared to previous campaigns.

- Quality of Leads: The personalized approach attracted highly qualified leads who were genuinely interested in the services offered.

- Brand Awareness: The visually appealing ads increased brand visibility and recognition among the target audience.

- Improved ROI: The cost per conversion decreased by 20% due to optimized ad targeting and compelling content.

2. Case Study: Building Financial Confidence for Millennials

Objective: A financial coaching service sought to connect with millennials struggling with financial decisions and empower them to achieve their financial goals.

Strategy:

- Understanding the Audience: The campaign extensively researched millennial pain points related to finances, such as student loan debt, budgeting, and saving for major life events.

- Educational Content: Ad content focused on providing valuable financial education and actionable tips, positioning the service as a trusted resource.

- Testimonials: Real success stories and testimonials from millennials who benefited from the coaching service added credibility and trust.

- Custom Audiences: The service created custom audiences based on website visitors and engaged social media users, ensuring they stayed top-of-mind.

Impact:

- Engagement: The campaign saw a significant increase in engagement, with a 45% higher click-through rate compared to industry benchmarks.

- Brand Authority: By sharing educational content, the service established itself as an authority in financial coaching among millennials.

- Lead Nurturing: The custom audiences allowed for effective lead nurturing, resulting in a 25% increase in conversions.

- Social Proof: Testimonials played a pivotal role in convincing potential clients of the coaching service’s effectiveness.

3. Case Study: Inspiring Financial Independence for Small Business Owners

Objective: A financial coaching service aimed to attract small business owners who sought guidance in managing their business finances effectively.

Strategy:

- Niche Targeting: The campaign used precise targeting to reach small business owners based on their interests, industries, and business challenges.

- Problem-Solution Approach: Ad content addressed common financial challenges faced by small business owners and positioned coaching as the solution.

- Webinar Promotion: Promoting a free webinar on financial planning for small businesses increased engagement and provided value upfront.

- Retargeting: Website retargeting and lookalike audiences expanded reach and improved lead quality.

Impact:

- Webinar Attendance: The campaign generated a record number of webinar sign-ups, with a 65% attendance rate.

- Lead Conversion: The personalized and problem-solving approach resulted in a 40% increase in lead conversion rates.

- Long-Term Relationships: The service developed long-term relationships with small business owners, leading to recurring coaching sessions and referrals.

These case studies showcase the power of Facebook advertising for financial coaching services. By employing audience segmentation, compelling ad content, visual appeal, and effective CTAs, these campaigns achieved remarkable success in lead generation, brand awareness, and conversion rates. Utilizing educational content, testimonials, and niche targeting helped establish trust and credibility, leading to increased engagement and conversions. The results of these case studies illustrate how financial coaching services can leverage Facebook advertising to outrank competitors and connect with their target audience in a meaningful and impactful way.