Will Value-added Tax (VAT) affect your Twitter advertising? Let’s dive into the murky waters of digital taxation and see if VAT does or does not affect your Twitter ad campaigns.

The answer is not simply ‘yes’ or ‘no.’ VAT applies to Twitter advertising, in part, because it affects a number of factors, including where your company is located and what services are provided. By breaking these elements down, we can comprehend the intricate web of VAT, as well as its connection to the Twitterverse.

You will gain a better understanding of the ever-changing landscape of digital taxation as you study this section. Discover the nuances of VAT on Twitter advertising, as well as learn how to make the most of the knowledge you gain. If you are prepared to untangle the threads, let us look at the intersection of taxes and tweets. Here’s where you’ll begin the process of becoming VAT clear.

Understanding VAT (Value-Added Tax)

Amidst the intricate web of global commerce and financial transactions, the concept of Value-Added Tax (VAT) emerges as a pivotal player, wielding a profound influence on economies and businesses across the world. Unraveling the intricate tapestry of VAT calls for an exploration into its fundamental underpinnings, implementation strategies, and the imperative role it plays in shaping contemporary fiscal landscapes.

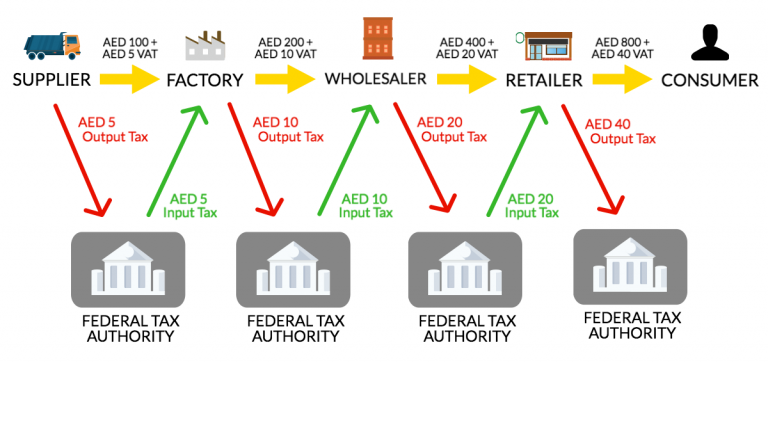

VAT Basics: At its core, VAT is a consumption tax meticulously woven into the fabric of transactions involving goods and services. With each step of the production and distribution process, value is added, and so is the tax. This compounding approach ensures that VAT becomes inherent in the final price paid by the end consumer, creating a seamless cascade of tax collection. This financial ripple effect, reminiscent of a pebble dropped into a pond, ensures that revenue streams flow not only from manufacturers to consumers but through the entire spectrum of intermediaries. The variations in VAT forms, whether it be the comprehensive approach of the EU or the more tailored methods of individual nations, underscore its adaptability to diverse economic structures and needs.

VAT Implementation: The intricate mechanics of VAT implementation dance to a rhythmic tune set by tax authorities and businesses alike. VAT is a transactional tax, applied at each step where value is added, rendering it a self-policing mechanism. Manufacturers, distributors, and retailers collectively form the cogs in this taxation machinery, with each entity bearing the responsibility of accounting for VAT at their respective stages. This orchestration demands meticulous record-keeping, ensuring that tax authorities can seamlessly trace the trail of VAT from inception to consumption. For businesses, VAT collections metamorphose into funds temporarily held on behalf of tax authorities, emphasizing the symbiotic relationship between economic stakeholders and government treasuries.

Role of Businesses: In this intricate choreography of VAT, businesses take center stage as both collectors and remitters. As goods and services traverse the supply chain, businesses shoulder the responsibility of collecting VAT from their customers, contributing to the government’s coffers. The periodic settlement of collected VAT, often through VAT returns, reflects the fluidity of this financial arrangement. This dual role of businesses – acting as both financial intermediaries and enforcers of tax compliance – underscores their integral position within the VAT ecosystem.

Importance of VAT Classification: Amid the labyrinthine structure of VAT, the significance of proper classification emerges as a beacon of clarity. Accurate classification of goods and services underpins the determination of applicable VAT rates and exemptions, ensuring equitable taxation. This task is no trivial matter, as misclassification can lead to unintended financial consequences for both businesses and consumers. The classification process serves as a map, guiding stakeholders through the intricate terrain of VAT regulations and aiding in making informed financial decisions.

As economies continue to evolve, VAT’s role persists as a linchpin in their fiscal machinery. Its dynamic nature, adapting to economic nuances, underscores its indispensability. Beyond its financial implications, VAT serves as a testament to the intricate balance between commerce and governance, a nexus where businesses collaborate with authorities to propel economic growth. In this ever-evolving landscape, understanding VAT’s intricacies not only safeguards businesses from financial pitfalls but also fosters a deeper appreciation for the nuanced interplay between taxation and economic progress.

Twitter Advertising: Unveiling the Landscape

In the pulsating heart of the digital realm, Twitter Advertising emerges as a potent force, propelling businesses into the spotlight with a potential reach that spans the globe. As we embark on this journey through the intricate world of Twitter advertising, a tapestry of opportunities and complexities unfurls before us.

Twitter Advertising Overview: Picture this – a succinct message, encapsulating the essence of your brand, projected across the screens of millions. Twitter advertising embodies this narrative, where businesses harness the power of 280 characters to carve their mark in the digital consciousness. From Promoted Tweets that blend seamlessly with the user’s feed, to captivating Promoted Videos that tell stories in motion, the options are as diverse as the business landscape itself. Whether it’s sparking conversations, igniting trends, or fostering engagement, Twitter advertising is an avenue where brands forge connections beyond boundaries.

Taxation in Digital Advertising: However, amidst the realm of pixels and hashtags, another layer of complexity unfolds – taxation in the digital advertising sphere. The digital economy, akin to an intangible web spanning continents, has challenged traditional tax frameworks. Digital advertising, a cornerstone of this brave new world, treads the line between tangible goods and ephemeral services, leaving tax authorities grappling to define its contours. As we navigate the labyrinth of global commerce, efforts to adapt taxation to this dynamic landscape gain momentum. Countries across the map, from the United States to the European Union, are taking strides to bridge the gap between digital transactions and equitable taxation. This endeavor goes beyond mere fiscal considerations; it’s a quest to establish a fair playing field for businesses in a digital arena where boundaries blur, and revenue flows as swiftly as data.

Untangling the Threads: This juxtaposition of Twitter advertising and taxation in the digital age creates an intricate web of opportunities and challenges for businesses. The fusion of these realms isn’t just about crafting compelling messages; it’s about understanding the evolving nature of commerce and communication. It’s about realizing that each hashtag and retweet can have financial implications that ripple across borders. It’s about comprehending the weighty responsibility that businesses bear as they navigate this landscape, ensuring compliance with tax regulations while capitalizing on the vast potential of digital advertising.

As the world continues its digital metamorphosis, the synergy between Twitter advertising and taxation stands as a testament to the multifaceted nature of modern business. It’s a realm where the power to connect, engage, and influence converges with the imperative of responsible financial management. Navigating this landscape requires a delicate balance – an amalgamation of creativity and compliance, of digital prowess and fiscal prudence. By embracing this equilibrium, businesses can position themselves not only as leaders in their industries but also as pioneers in a realm where pixels and policies intertwine.

In this voyage through the intricate nexus of Twitter advertising and taxation, one thing becomes resoundingly clear: the digital landscape is not a realm of isolation, but a tapestry where every thread, every tweet, contributes to the grand narrative of global commerce. As we thread our way through this landscape, let us seize the opportunities, unravel the complexities, and navigate the currents with the knowledge that our journey isn’t just one of promotion, but of progress – a progress where innovation meets responsibility and success is measured not only in clicks but in the meaningful impact on a digital world in constant flux.

VAT and Digital Advertising: Navigating the Connection

In the sprawling expanse of the digital landscape, where transactions occur at the speed of a click and ideas traverse borders with effortless fluidity, the entwined realms of Value-Added Tax (VAT) and digital advertising beckon businesses to navigate a terrain fraught with both promise and intricacy.

VAT on Digital Services: Imagine the digital highway as a thoroughfare of commerce, with each digital service acting as a toll booth where VAT collects its dues. VAT’s reach extends across the global digital panorama, weaving a complex tapestry of taxation rules and regulations that vary from one jurisdiction to another. A closer look reveals that digital services of all kinds—ranging from app downloads to online subscriptions—are subject to VAT, a testament to the ever-expanding scope of this tax model. As businesses embark on their digital journeys, they encounter not just the enigma of zeros and ones, but also the challenge of understanding how VAT applies to their digital ventures.

Determining VAT Applicability to Twitter Advertising: Amidst this digital labyrinth, the spotlight falls on Twitter advertising—an avenue where succinct messages transcend geographical boundaries. But does the VAT net encompass these fleeting messages? The answer lies in a complex interplay of factors. Factors that extend beyond the digital realm to encompass the realm of geography. The location of the business, the location of the recipient, and the nature of the service rendered form a trinity that determines whether the VAT curtain rises on Twitter advertising. This intricate dance of factors underscores the need for meticulous navigation, ensuring that businesses don’t just capture attention but also adhere to tax regulations that span the global digital tapestry.

VAT Registration and Compliance: As businesses traverse this interwoven realm of digital advertising and VAT, a call to action emerges in the form of VAT registration and compliance. The digital realm’s borderless nature prompts businesses to contemplate not just their creative strategies, but also the imperative of being tax compliant. VAT registration emerges as the gateway that businesses must cross, allowing them to participate in the digital marketplace while adhering to the legal fabric that binds transactions. However, the realm of compliance extends far beyond registration—it delves into the realm of meticulous record-keeping, timely remittances, and an understanding of VAT regulations that safeguard businesses from unintended consequences. The consequences of non-compliance loom as more than just financial penalties; they disrupt the delicate equilibrium between commerce and governance, impacting reputation, trust, and the very foundation on which businesses thrive.

Charting a Course Through Complexity: In this intricate interplay of VAT and digital advertising, businesses stand at the crossroads of complexity and opportunity. The digital realm, once a realm of limitless horizons, becomes an arena where every pixel bears a financial weight. The challenge lies not just in crafting compelling messages that resonate in the digital echo chamber, but also in understanding the financial symphony that plays in the background—a symphony where VAT’s notes harmonize with each digital transaction. To navigate this symphony, businesses must don the roles of both creators and financiers, capturing attention while navigating the intricacies of VAT.

As businesses embark on their journey through the intertwining realms of VAT and digital advertising, they enter a world where every click holds a financial whisper and every engagement reverberates in the corridors of taxation. This journey isn’t one of mere advertising—it’s a voyage that reshapes the contours of commerce, a voyage where businesses don’t just market their wares, but also navigate the tax currents that ebb and flow in the digital tide. By understanding the VAT nuances, charting compliance pathways, and weaving digital strategies that harmonize with fiscal responsibilities, businesses transcend the realm of advertising to become pioneers of a digital world that beckons with opportunities, challenges, and a call for responsible innovation.

Unpacking Twitter Advertising and VAT: Case Studies

In the dynamic realm where Twitter’s 280-character canvases converge with the intricate fabric of Value-Added Tax (VAT), case studies emerge as invaluable compasses, guiding businesses through the uncharted waters where digital advertising meets fiscal responsibility. These real-world narratives delve into the VAT treatment of Twitter advertising across different jurisdictions, revealing insights that transcend borders and redefining the calculus of global business strategies.

Jurisdiction-specific Case Study 1: Imagine a specific country where VAT casts its shadow over the realm of Twitter advertising, prompting businesses to navigate the intricacies of compliance. This case study is a tapestry woven with implications—implications that ripple through the strategies of businesses operating within the jurisdiction. From the cautious structuring of advertising budgets to the strategic alignment of campaigns, each decision bears the imprint of VAT’s financial footprint. The case study unfurls the nuances of this VAT landscape, where businesses must navigate not just the intricacies of Twitter advertising but also the fiscal responsibilities that accompany it.

Jurisdiction-specific Case Study 2: As the digital horizon stretches across borders, another country’s approach to VAT on Twitter advertising enters the spotlight. Here, the lessons learned resonate beyond geographical confines, offering insights that transcend borders. An analytical dissection of this approach offers a window into the variations that exist in VAT application, unveiling a tapestry where tax authorities and businesses perform a delicate dance. The lessons gleaned extend beyond compliance; they underscore the necessity of adaptability and proactive navigation in a landscape where regulations morph with digital innovations.

Lessons Across Borders: These jurisdiction-specific case studies hold lessons that transcend their individual contexts. From Case Study 1, businesses glean the importance of a vigilant gaze on tax regulations, embedding compliance into the very core of their advertising endeavors. Case Study 2 sheds light on the power of adaptation—an ability to embrace different tax landscapes, each with its own set of challenges and opportunities. This cross-border knowledge exchange reshapes the narrative of digital advertising and VAT, transforming it from an esoteric realm to a dynamic intersection where creativity and fiscal responsibility coalesce.

In this era of globalization, case studies transcend their role as mere documentation, emerging as beacons that illuminate the paths businesses must tread. These real-world narratives shatter the notion that Twitter advertising exists within a vacuum, unburdened by fiscal considerations. Instead, they underscore the inextricable connection between creative strategies and financial prudence, a connection that traverses continents and binds businesses in a global dialogue.

As the digital tapestry expands, these case studies stand as pillars that guide businesses through the complexities of VAT and Twitter advertising. They validate the adage that knowledge is power—power to craft informed strategies, power to align creativity with compliance, and power to navigate the ever-evolving landscape of digital commerce. In a world where the intersection of tweets and taxes isn’t just theoretical but practical, case studies transcend the abstract and become the bridge that connects businesses to success in the digital age.

Twitter Advertising: Seeking Expert Opinions

In the sprawling digital arena, where tweets traverse the global ether, seeking expert insights becomes the lodestar that guides businesses through the intricate nexus of Twitter advertising and Value-Added Tax (VAT). This quest for wisdom unveils a tapestry woven with perspectives from tax experts and business luminaries, shedding light on the complex interplay of fiscal responsibility and innovative marketing.

Interview with Tax Expert: Imagine a conversation with a tax expert—a voyage into the labyrinth of challenges that beset the taxation of digital advertising. In this dialogue, the intricacies of taxing digital services become palpable, revealing a landscape that defies traditional tax frameworks. As the digital horizon evolves, the expert’s foresight provides a compass that points toward potential developments in VAT on digital services. Insights gleaned from this discourse ripple through businesses, offering a vantage point that transcends immediate concerns and gazes into the future of digital taxation.

Business Perspectives: In a parallel thread, the voices of businesses that have navigated the realm of VAT on Twitter advertising echo with real-world experiences and insights. These narratives aren’t just anecdotes; they are gems of wisdom that businesses unearth as they tread the path of VAT compliance. Challenges are revealed—not as obstacles to deter, but as stepping stones for others to anticipate. These businesses offer more than just accounts of their journey; they provide suggestions that pave the way for smoother compliance, drawing from the well of their experiences.

In this symphony of expert opinions and business perspectives, a tapestry of knowledge emerges. This knowledge is a torch that illuminates the paths of businesses operating in the dynamic realm where Twitter advertising collides with VAT. These insights aren’t confined to the realm of abstraction; they are tools that businesses can wield to craft strategies that resonate with both creativity and fiscal responsibility. They are signposts that guide businesses to success in an arena where tweets have financial echoes and every engagement carries a tax implication.

As businesses navigate the intricate interplay of Twitter advertising and VAT, seeking expert opinions becomes more than a choice—it becomes a necessity. The digital age thrives on information, and in this age, knowledge isn’t just power; it’s a differentiator. The insights from tax experts map the course of evolving tax landscapes, while the experiences of businesses reveal the practical nuances that transform theory into practice. The fusion of these perspectives constructs a foundation that businesses can stand upon, fostering innovation that is both visionary and grounded in compliance.

In a world where every tweet has potential financial reverberations, seeking expert opinions is a strategic move that businesses cannot afford to overlook. It’s a quest that underscores the synergy between innovation and responsibility, where business strategies are crafted not just for visibility but for resilience. As the digital tapestry continues to unfurl, expert opinions and business insights stand as beacons, guiding businesses through a landscape where every character typed is more than just a message—it’s a financial decision that ripples through the digital currents.

Navigating VAT on Twitter Advertising: Best Practices

In the intricate dance between Twitter’s ephemeral narratives and the complex realm of Value-Added Tax (VAT), businesses are faced with a dual mandate: to captivate audiences with compelling advertising while adhering to the ever-evolving landscape of fiscal compliance. The voyage through this terrain isn’t navigable solely through chance; it demands a compass composed of best practices that have proven invaluable in the intersection of creativity and fiscal responsibility.

Consulting Tax Professionals: Imagine standing at the crossroads of tweets and taxes, armed with the wisdom of tax professionals well-versed in the nuances of digital taxation. The strategic importance of seeking counsel from these experts is as vital as the pixels that form a tweet. Their insights navigate businesses through the labyrinth of digital taxation, unearthing the complexities that lurk beneath the surface. By proactively engaging tax professionals, businesses not only anticipate potential challenges but also position themselves to craft advertising campaigns that are not only creative but also fiscally sound. These professionals aren’t just advisors; they are architects of compliance in a world where tax regulations mirror the speed of digital evolution.

Documentation and Record-Keeping: Amidst the flurry of retweets and hashtags, a quieter practice emerges—one that involves meticulous documentation and record-keeping. This practice, often underappreciated, is the backbone of VAT compliance. The imperative of maintaining accurate records echoes with each character typed, each advertisement posted. These records serve as a narrative of compliance, chronicling the journey from concept to engagement. Among the documents that businesses must retain, invoices, contracts, and evidence of payment take center stage. They are not just paper or electronic trails; they are the tangible proofs of adherence to tax regulations, assuring tax authorities of businesses’ commitment to transparency and fiscal responsibility.

In the ever-shifting landscape of digital advertising and VAT, these best practices stand as sentinels, guarding against unintended pitfalls and fostering a culture of compliance. They are not mere checkboxes to be ticked; they are the ingredients that transform campaigns into strategies, transforming advertisements into narratives that resonate not just with audiences but with fiscal authorities as well.

These best practices transcend borders and industries, uniting businesses in their quest for success in a digital realm where every engagement carries more than just creative potential—it carries financial implications. By harnessing the wisdom of tax professionals and embracing diligent record-keeping, businesses forge a path that merges creativity and compliance, innovation and fiscal responsibility. This fusion isn’t just a theoretical construct; it’s a practical manifestation of a strategy that navigates the intricate web of VAT on Twitter advertising.

As businesses venture into this realm, they embody a new paradigm—one where success isn’t measured solely in likes and retweets but in the meticulous adherence to tax regulations that ensure the longevity of operations. These best practices aren’t just theoretical musings; they are the tools that businesses wield to craft advertising campaigns that are as strategic as they are creative, campaigns that don’t just capture attention but also stand the test of fiscal scrutiny.

In this era of digital interconnectedness, best practices aren’t just guidelines; they are the unsung heroes that fortify businesses against the vagaries of evolving tax landscapes. They shape strategies that transcend the digital canvas and navigate the nexus of tweets and taxes, positioning businesses not just as innovators in advertising but also as pioneers in responsible fiscal management.